- What is Swing Trading and Why BTC?

- Why Swing Trade Bitcoin on OKX?

- Getting Started: OKX Setup Guide

- Top BTC Swing Trading Strategies

- Trend Following with Moving Averages

- Support/Resistance Breakouts

- RSI Divergence Plays

- Risk Management Essentials

- Must-Use OKX Trading Tools

- Common Swing Trading Mistakes to Avoid

- BTC Swing Trading FAQ

- How much capital do I need to start?

- What’s the ideal holding period for BTC swings?

- Does OKX charge for withdrawals?

- Can I automate swing trades on OKX?

- How do taxes work for swing trading?

- Is swing trading profitable long-term?

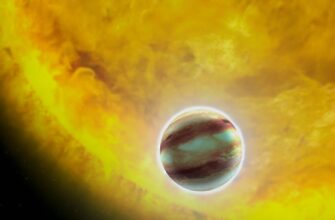

What is Swing Trading and Why BTC?

Swing trading involves holding assets like Bitcoin for several days to weeks to profit from price ‘swings.’ Unlike day trading, it doesn’t require constant monitoring, making it ideal for busy traders. Bitcoin’s volatility creates frequent 10-20% price movements, offering prime swing trading opportunities when combined with OKX’s advanced tools.

Why Swing Trade Bitcoin on OKX?

OKX stands out for BTC swing trading with:

- High Liquidity: Deep order books ensure smooth entry/exit

- Low Fees: 0.08% maker/taker fees (lower with OKB holdings)

- Advanced Charting: 100+ indicators and drawing tools

- Robust Security: 98% cold storage and proof-of-reserves

- Earn Opportunities</strong: Staking rewards while holding positions

Getting Started: OKX Setup Guide

Follow these steps to begin:

- Create an account at OKX.com with KYC verification

- Deposit USD/USDT via bank transfer or card

- Navigate to ‘Trade’ > ‘Spot Trading’

- Search for BTC/USDT trading pair

- Enable basic chart indicators (SMA/RSI)

Top BTC Swing Trading Strategies

Trend Following with Moving Averages

Use 50-day and 200-day SMAs on OKX charts. Buy when 50 SMA crosses above 200 SMA (golden cross), sell when it crosses below (death cross).

Support/Resistance Breakouts

Identify consolidation zones using horizontal lines. Enter long when price breaks above resistance with increased volume, set stop-loss 5% below entry.

RSI Divergence Plays

Watch for when price makes lower lows but RSI makes higher lows (bullish divergence) or vice versa (bearish divergence). Confirms reversals.

Risk Management Essentials

- Position Sizing: Never risk >2% of capital per trade

- Stop-Loss Orders: Mandatory for every position (use OKX’s stop-limit orders)

- Take-Profit Levels: Set at 2:1 or 3:1 reward-risk ratio

- Correlation Checks: Monitor Bitcoin dominance and macro trends

Must-Use OKX Trading Tools

Maximize efficiency with:

- Price Alerts: Get notified at key levels

- TradingView Integration: Advanced technical analysis

- Grid Trading: Automate range-bound strategies

- Margin Trading: Amplify gains (use cautiously)

Common Swing Trading Mistakes to Avoid

- Overtrading during low volatility periods

- Ignoring Bitcoin news/events (halvings, regulations)

- Moving stop-losses against the trend

- Chasing pumps without confirmation

- Neglecting exchange security (enable 2FA!)

BTC Swing Trading FAQ

How much capital do I need to start?

Minimum $500 recommended to properly implement risk management, though OKX has no minimum deposit.

What’s the ideal holding period for BTC swings?

Typically 3-10 days. Monitor 4-hour/daily charts for exit signals.

Does OKX charge for withdrawals?

BTC withdrawals cost 0.0005 BTC (dynamic during high congestion).

Can I automate swing trades on OKX?

Yes! Use API connections with TradingView or OKX’s native strategy bots for semi-automation.

How do taxes work for swing trading?

Most countries treat crypto trading as taxable events. Track all transactions using OKX’s exportable history.

Is swing trading profitable long-term?

With strict discipline, backtesting, and risk management, yes. Aim for 5-10% monthly returns realistically.